The Village collects a 3% lodging tax for all qualifying short-term lodging establishments. This includes hotels, airbnbs, and many other types. To find out more, visit Village Code Chapter 882 or our Lodging Tax Frequently Asked Questions.

All operators of a qualifying lodging establishment must register annually and must submit lodging tax twice a year.

The Lodging Tax Form can be accessed by clicking here - Lodging Tax Form

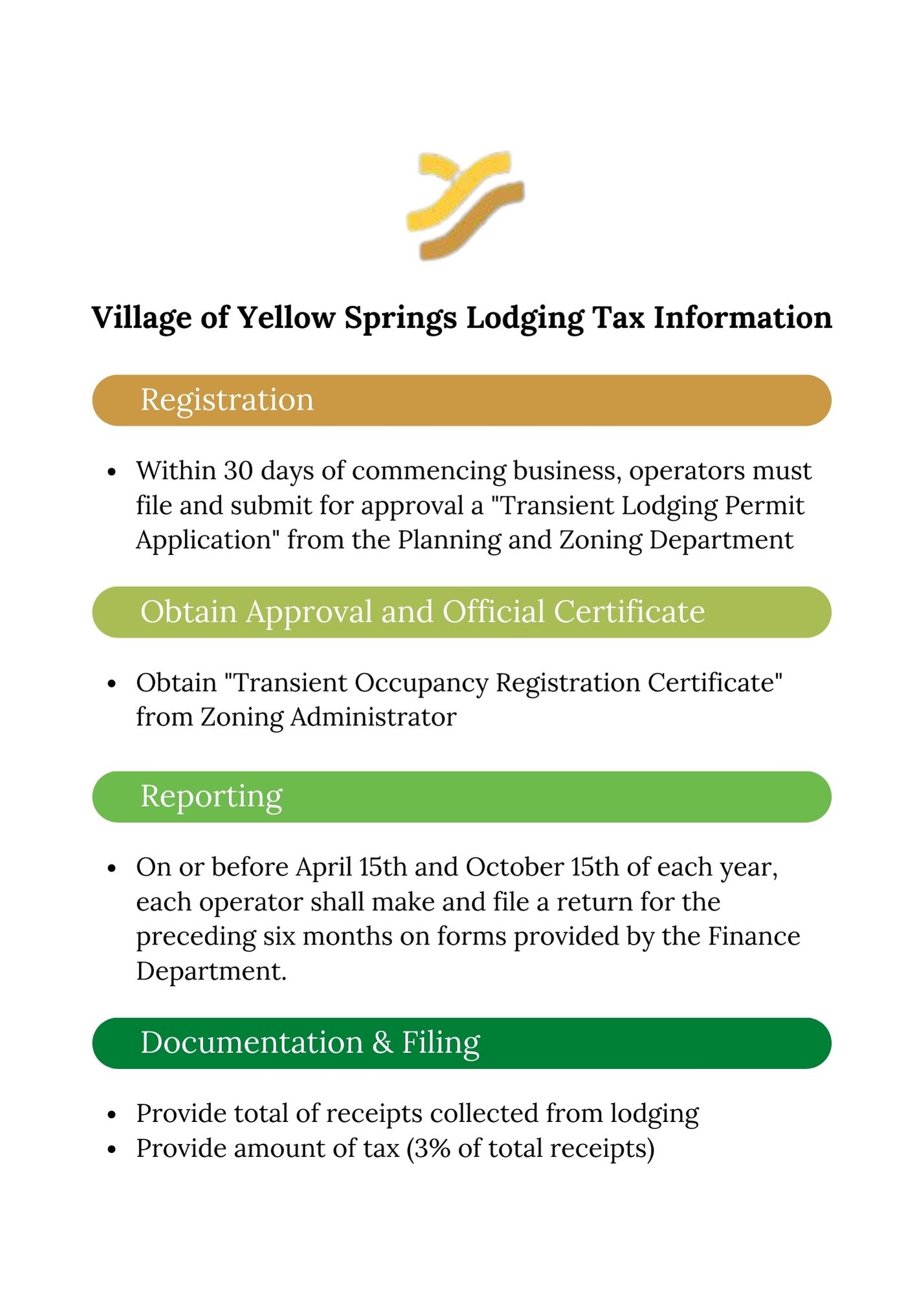

You may refer to the graphic below for information on this process:

Ordinance 2017-14 "Enacting New Chapter 882 Entitled Lodging Excise Tax of the Codified Ordinances of the Village of Yellow Springs, Ohio Effective January 1, 2018" on September 5, 2017. This ordinance implements a lodging tax of 3% on all lodging establishments within the Village beginning January 1, 2018 with collections beginning on July 31, 2018. Please refer to the ordinance in full by clicking here.